Announcement:

Please be informed that there will be no daily market outlook for the coming two weeks as I will be away for my vacation, however, stocks and futures’ research report/ market outlook from our company will remain available for your reference. You can re-access to this site starting 5th of June 2013.

Astro

Last Done: RM3.16

Technically, the stock has reached its peak and minor retracement is expected to set in. However, not much to be expected from the stock as the stock will hover within the tight trading range of RM3.00 to RM3.40 level.

The immediate support is seen at RM3.00, followed by RM2.50 and the immediate resistance is seen at RM3.50 level, followed by RM3.80.

FKLI

Downside Bias…

The FKLI will need to close the gap created after the election (1720 – 1700 levels), thus, further downside is expected with the 1st level of reliable support is seen at 1700 only. Any long position initiation will need to take extra cautious, especially with most of the index members trading into uncharted territory.

Risk averse investors should not hold any position for overnight and any position initiation should couple with tight stop loss.

Risk taker investors can initiate short position, especially any level near to 1800 with stop loss level around 1820 level.

The immediate support is seen at 1750, followed by 1720 level and the immediate resistance is seen at 1780, followed by 1800 level.

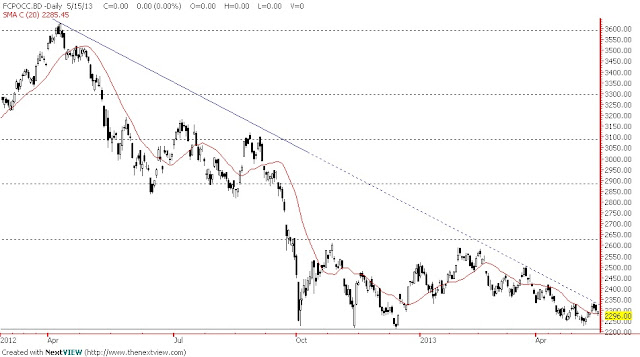

FCPO

Hovering around the Downtrend Line…

The FCPO will need to take over the 2330 level (the downtrend line) before further upside can set in. The FCPO will need to take over the 2330 level convincingly, else, the long term downward trading will resume. The downtrend line currently located at the 2330 level, forcing the FCPO to trade within the range of 2330 to 2200 levels. Taking over the 2330 level will give us a good opportunity to initiate long position.

The immediate important support is seen at 2300 level, followed by 2250 and the immediate resistance is seen at 2350 level, followed by 2400 level.

Disclaimer:

The information herein was obtained or derived from the source that I believed are reliable. No liability can be accepted for any loss that may arise from the use of this report. All opinions and estimates included in this report constitute my judgment as of this date, not an invitation to buy and are subject to change without further notice.